What You Need to Know About Importing Goods

As an eCommerce professional, when the topic of cross-border shipping comes up you are likely thinking about it in the context of exporting goods to the US. While it is certainly important to be knowledgeable about export, it is equally important to be well-versed on the importing of goods into Canada.

Like cross-border shipping, importing goods into Canada can be a difficult and confusing if not treated carefully. That’s why this week on the blog we’re providing you with the information you’ll need to quickly and safely see your goods shipped into Canada when the time comes.

Why Do I Need to Import Goods?

This is a fair question, especially if your eCommerce business is still in its early stages.

The most common reason an eCommerce business may need to import goods is simply because there is a demand for them. Statistics from the International Trade Administration show that Canadians spend over 60% of their disposable income on goods and services from the US, and so as a Canadian business owner it’s worthwhile to import and sell these goods.

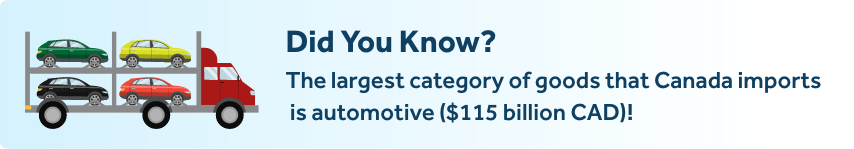

Import also plays a major role in the manufacturing side of things as well. Oftentimes the cost of raw materials, as well as the cost to manufacture goods, will be lower when sourced outside of Canada. For instance, in 2021 consumer electronics imported to Canada were valued at over $55 billion CAD.

Source: https://www.thecanadianencyclopedia.ca/en/article/imports

How Do I Import Goods?

As we mentioned at the top of the blog, any time goods need to cross national borders, the shipping process becomes more complicated. Below are the crucial steps that you need to consider when you import into Canada.

Get Information About Imported Goods

Firstly, it is important to check if the goods you plan on importing are allowed to be imported into Canada. A comprehensive list of prohibited goods can be found via the Canadian Border Service Agency (CBSA).

Many imported goods, such as textiles and clothing, require specific permits to enter Canada. Without these, the shipment may be refused at the border. More information can be found on the CBSA website on importing consumer goods into Canada.

As with any form of shipping, the more information you can provide the better. This includes the description of the goods, weight and dimensions of the shipment, and the countries of origin – both the country from which you are importing the goods, and the countries of origin of any of the individual parts of the goods, if necessary. Further, You will want to ensure that whoever is exporting your goods into Canada also follows the Canadian Label Requirements.

The above information is required under the Memorandum D11-4-2 for Proof of Origin, Memorandum D11-3-2 Marking of Imported Goods and the Canadian Border Services Agency (CBSA). This information is critical when it comes to tariff classifications of the imported goods.

Determine Your Duties and Taxes

You will need to calculate how much duty and tax you will have to pay based on tariff classification, tariff treatment, rate of duty and tax on imported goods.

The rate of duty on your goods will be determined using a Harmonized System (HS) classification number, which can be determined by consulting the Canadian Customs Tariff Guide. It is important to take note that on any goods imported you only pay the GST, even if you are in a province that charges HST. For more information on GST, excise tax or excise duty, contact the Canadian Revenue Agency.

For more information on how to determine the value of your shipments, refer to Memoranda Series D13 Valuation. To obtain an estimate or the proper exchange rate, contact the Border Information Services (BIS).

Consider a Customs Broker

No matter the size of your business, it can be worthwhile to hire a customs broker to assist you in the import process. A customs broker can obtain and prepare documents, arrange payments of customs duties and taxes, secure the release of imported goods, and make it easier for the goods to get through CBSA.

A broker’s service includes communicating with government agencies on behalf of your business and they ensure documents, duties, tax payments and other requirements are met when importing or exporting your goods.

It is important to note that, regardless of whether or not you employ the services of a customs broker, you are responsible for the documentation, payment of duties, taxes, and subsequent corrections such as re-determination of classification, origin, and valuation of your goods.

Check Exporter & Carrier Documentation

The exporter of the goods is responsible for preparing the following documentation:

- 1. Packing List: Description of goods in detail.

- 2. Bill of Landing: Details the type, quantity and destination of the goods being carried.

- 3. Commercial Invoice: Document of payment to your exporter.

- 4. Canada Customs Invoice: Declaring goods to customs when importing the goods.

- 5. Certificates of Origin: Breakdown of the origin of every part or material required for tariff treatments.

The carrier is responsible for preparing the Cargo Control Document, which uses information prepared from the exporter’s bill of landing documentation. The Cargo Control document is used to report goods to the CBSA, and an Electronic Data Interchange (EDI) system may be used to report the shipment.

Source: cbsa-asfc.gc.ca

ClickShip is Here for All Your Shipping Needs

Now that you can confidently import your goods into Canada, you need a tool to help make sure that, when the time comes to ship those goods out to your customers, you can do so quickly, easily, and for less. ClickShip can help with that.

Our easy-to-use platform offers discounted rates on domestic, cross-border, and international shipping from North America’s leading carriers, and integrates with the leading eCommerce platforms and marketplaces to pass those rates along to your customers right at checkout! Plus, with features like Smart Packaging, OneSKU Multi-Box, Custom Branding, and more, you can provide a shipping experience that is truly world-class.

Contact one of our shipping experts today and see how ClickShip can help your eCommerce business ship smarter.

Written by Brandon Draga

Brandon Draga is a full-time content writer at Freightcom, the leading shipping solution for businesses in Canada. When Brandon is not writing content to help businesses with their shipping needs, he can be found at local skate parks or writing fantasy novels.

Learn how ClickShip can help speed up your fulfillment process with our innovative, all-in-one shipping solution.

Focus on running your business. We’ll ship orders for you — as soon as they come in.